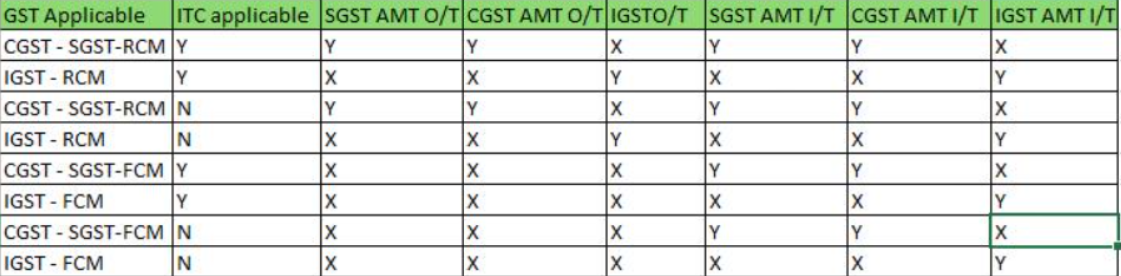

The GST amount may not appear correctly in the report due to the configuration of the ITCApplicable field.

-

If ITCApplicable is set to ‘Y’, the IGSTAMT I/T column will display 0.

-

If ITCApplicable is set to ‘N’, the value from IGSTAMT O/T will be shown in the IGSTAMT I/T column.

To ensure the GST amounts are displayed correctly in both sections, verify that the GST Applicability setting in the voucher includes options such as SGST-CGST-RCM and IGST-RCM.

While both GST values are calculated internally, the report reflects only the net GST amount based on a single GST calculation.