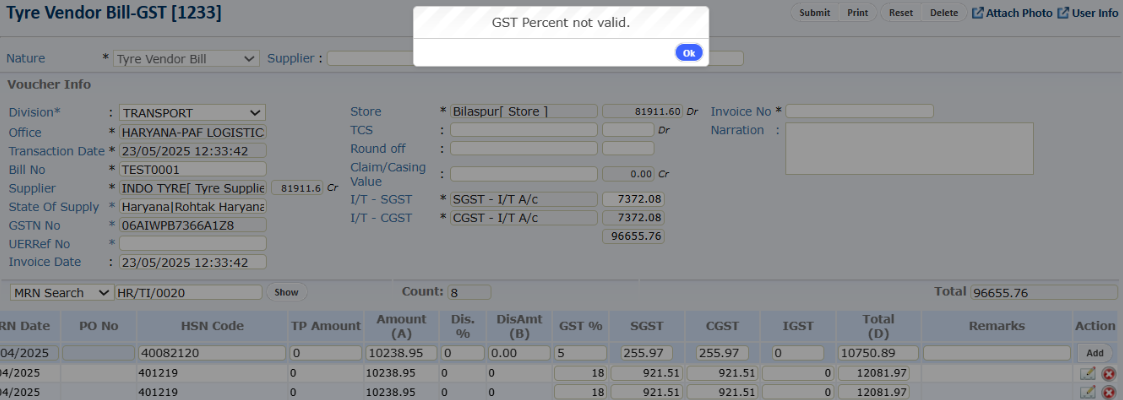

An alert appears when attempting to change the HSN code after a bill has been created against a MRN because the system allows only one GST rate per MRN. Once an MRN is associated with a specific GST rate, it cannot be edited to a different rate for subsequent bills.

This is expected behavior to maintain consistency in billing and tax calculations. Clients should be informed that for Old Tyre MRNs, only the pre-configured GST rate can be used. If a different rate is required, it indicates a discrepancy that the current system process cannot accommodate.