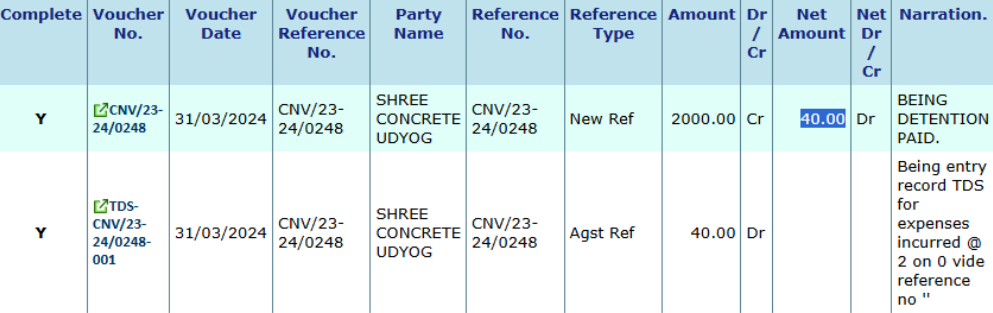

A payment may still appear as outstanding if there are deductions such as TDS or partial settlements. Even though a payment has been made against an invoice, the system reflects the net amount received.

For example, if a TDS deduction of ₹40 is applied, the system will continue to show that balance as outstanding. To resolve this, ensure that all deductions are properly accounted for and explain the impact of TDS or similar deductions to the client to avoid confusion.