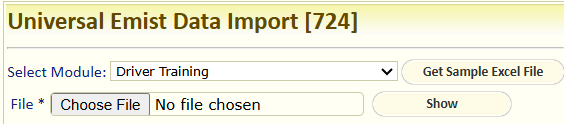

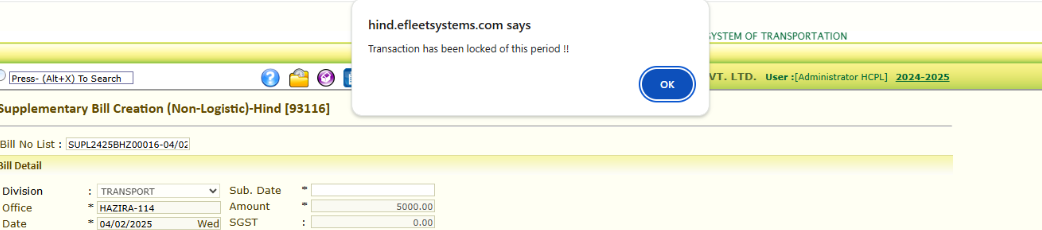

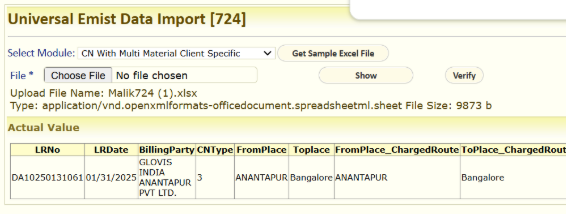

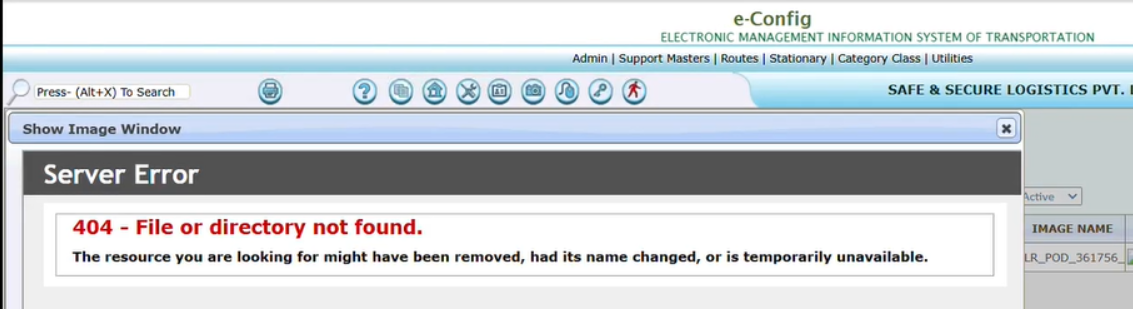

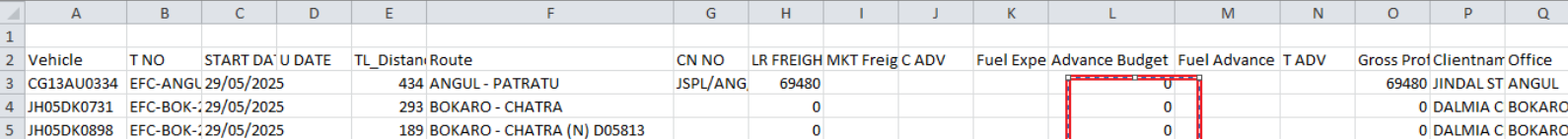

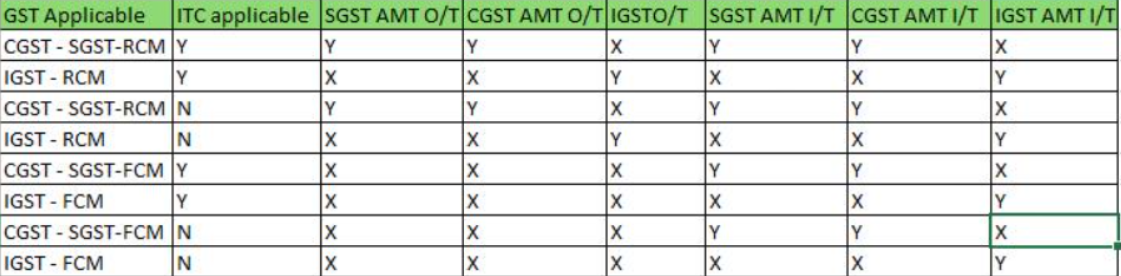

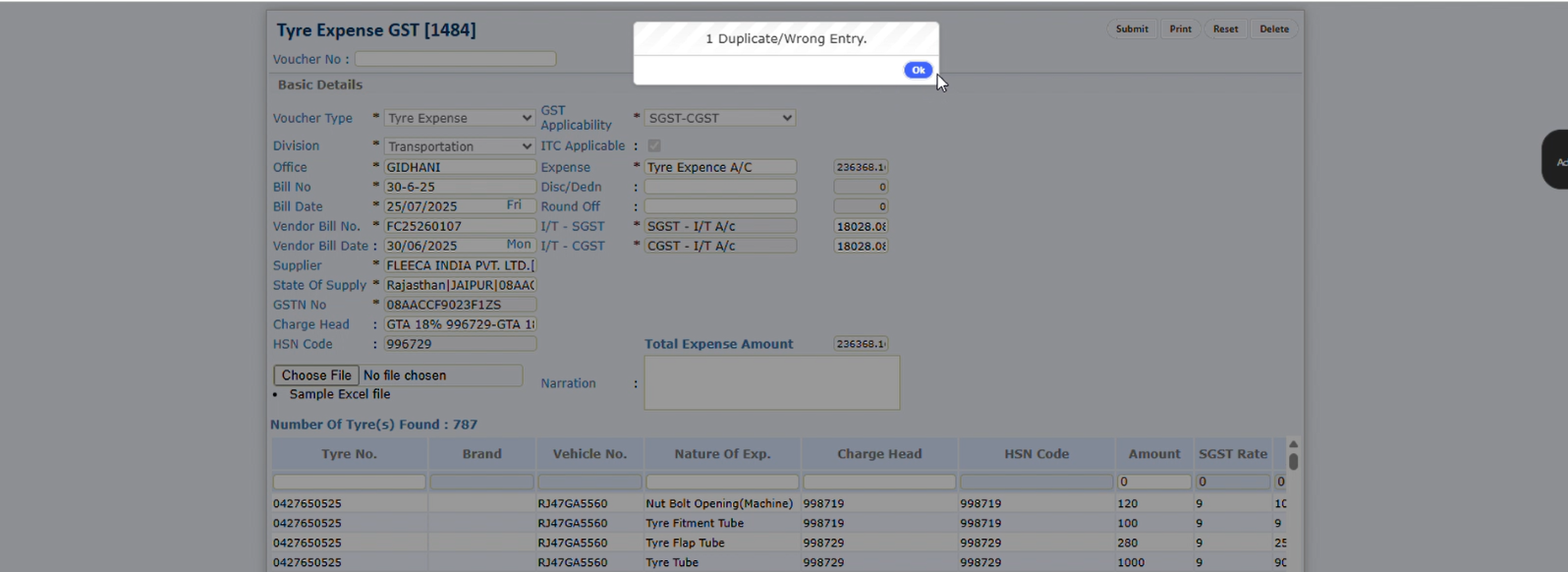

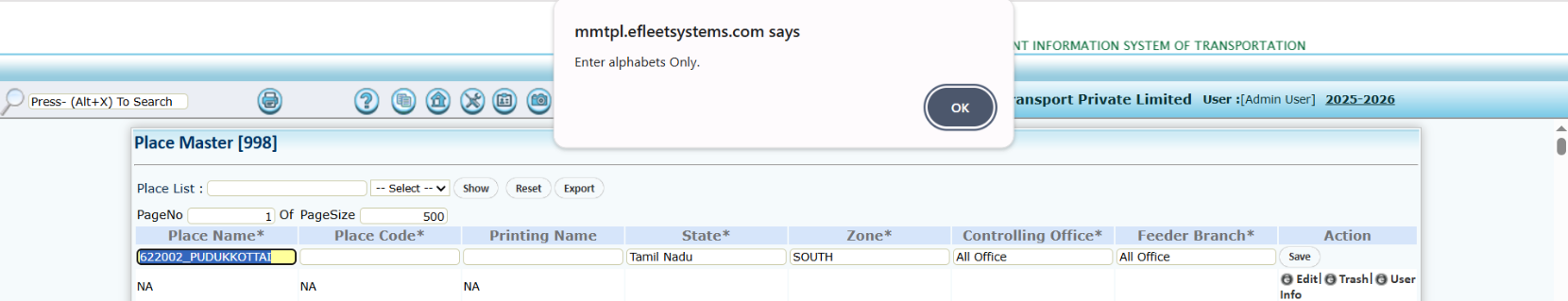

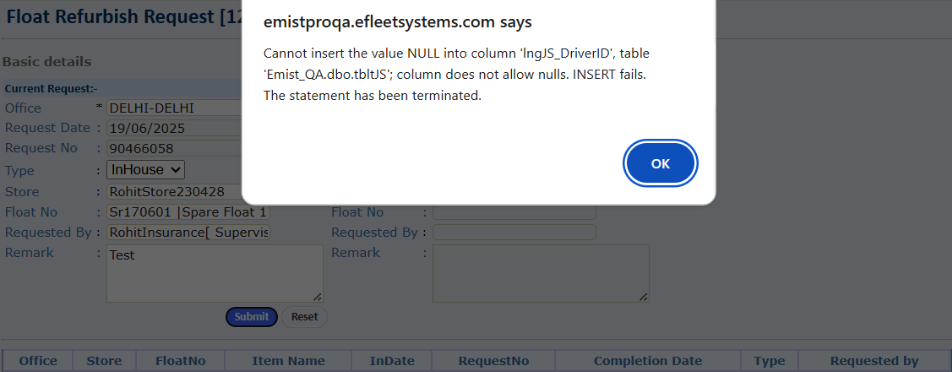

Error while Uploading Excel

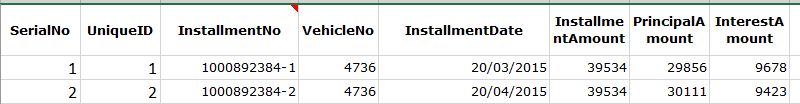

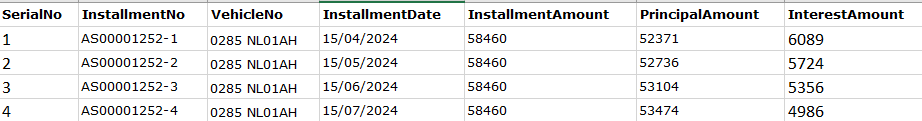

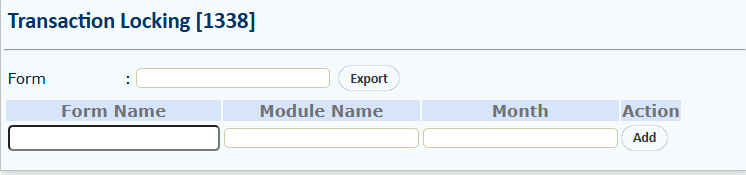

While uploading the Excel file on Form [724], ensure that the data entered in each column of the sheet is relevant and correctly aligned with the respective column headers. One of the most common causes of upload failure is data mismatch — where the values do not correspond to the expected format or content of that column. Double-check the format, data types, and mandatory fields before uploading.